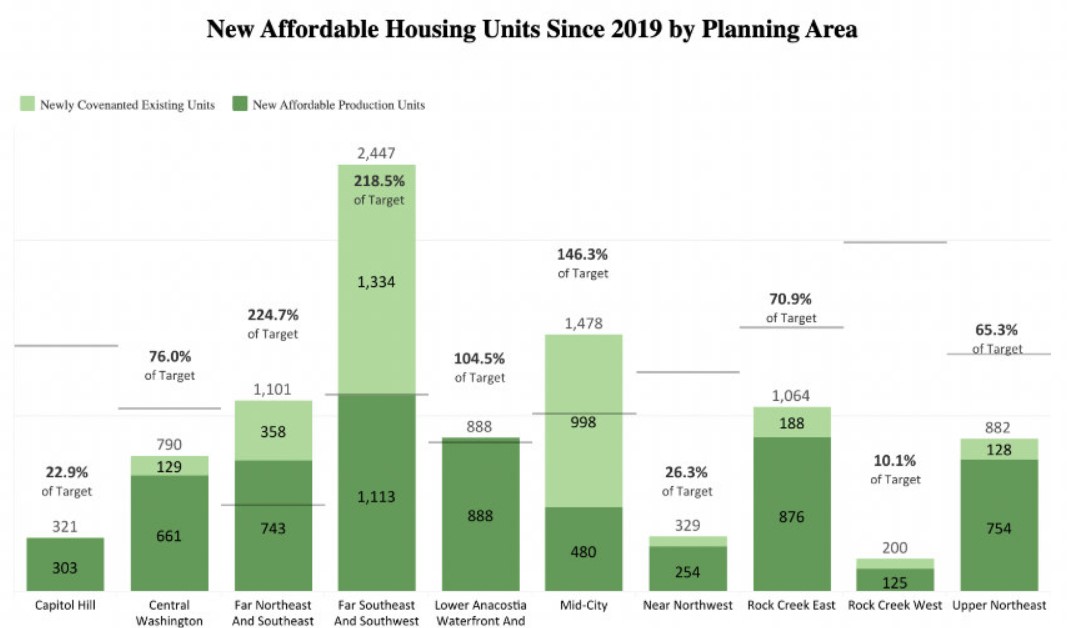

District Meets 96% Of 2025 Housing Goals

by UrbanTurf, May 7, 2024 DC continues to get close to meeting Mayor Muriel Bowser’s goal of producing 36,000 new housing units by 2025. Approximately 34,389 units delivered between January 2019 and April 2024, per the latest data available on…

Read more