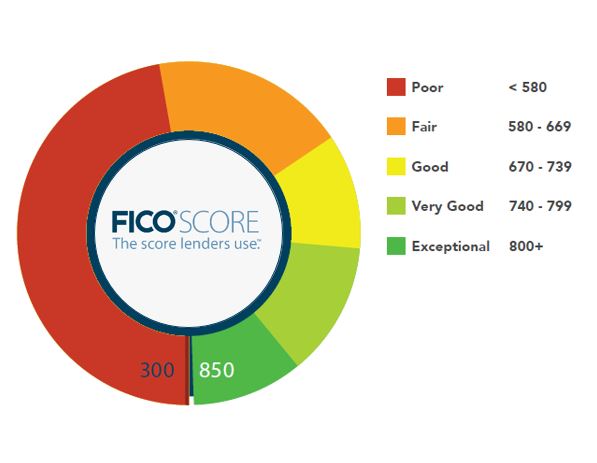

Fair Isaac Corporation, the purveyor of the FICO Score is rolling out a new credit score formula that will help borrowers who are regarded as too risky by lenders to obtain mortgages, credit cards and auto loans. The formula is currently being tested with credit-card issuers, and Fair Isaac said it hopes to upgrade as many as 53 million people with the new score.

Fair Isaac Corporation, the purveyor of the FICO Score is rolling out a new credit score formula that will help borrowers who are regarded as too risky by lenders to obtain mortgages, credit cards and auto loans. The formula is currently being tested with credit-card issuers, and Fair Isaac said it hopes to upgrade as many as 53 million people with the new score.

The new FICO changes to aid marginal borrowers by adding new financial variables, including consumers’ payment history with their cable, cellphone, electric and gas bills, as well as other factors including frequency of address changes. The new score puts less emphasis on unpaid medical bills and missed payments that have been paid off. In addition, under an agreement with New York State, the three major credit bureaus will be more proactive in resolving disputes over information contained in credit reports.

Tips On Improving Your Credit Score

____________________________

FICO Creates New Credit Metric For Risky Consumers

Banks could grant cards, loans to people previously unable to get a credit score

By AnnaMaria Andriotis, in the Wall Street Journal

Millions of Americans unable to obtain credit cards, mortgages and auto loans from banks will receive a boost with the launch of a new credit score aimed at consumers regarded as too risky by lenders.

The new metric, set to be announced as soon as this week, is being developed by Fair Isaac Corp., creator of the most widely used consumer-credit scores, and is being tested in a pilot phase with credit-card issuers. Fair Isaac said it hopes to make as many as 53 million people who don’t have credit scores more acceptable to lenders.

People without scores in most cases don’t use debt either by choice or because a negative credit event, such as a bankruptcy, foreclosure or a collection account, has shut them out of mainstream borrowing.

The new credit-scoring system will include information on how consumers pay their utility bills.

The new score is largely a response to banks’ desire to boost lending volumes by increasing loan originations to borrowers who otherwise wouldn’t qualify, many of whom tend to be charged more for loans. But the new yardstick will also throw a spotlight on consumers who often are deemed riskier than the rest of the population and could saddle banks with losses if they fail to make good on their loans.

The new score, which isn’t yet named, will be calculated based on consumers’ payment history with their cable, cellphone, electric and gas bills, as well as how often they change addresses and other factors, according to Fair Isaac, also known as FICO. Traditional FICO scores that lenders use in the approval or rejection process are calculated based on the information in the credit reports from the three major credit-reporting firms, Equifax Inc.,Experian PLC and TransUnion.

The new score will instead pull data from a separate database of telecommunications and utilities providers maintained by Equifax. It also will incorporate data from a LexisNexis database, including how often people change addresses, with frequent changes suggesting less stability.

FICO and 10 credit-card issuers, which the firm declined to name, have been quietly testing the new score since November. The firm plans to roll it out nationwide by around year-end. Some 15 million of the 53 million unscorable Americans already can be scored using the alternative data, said Jim Wehmann, executive vice president of scores at FICO.

Lenders often consider consumers who don’t have a credit score to be as risky or even riskier than so-called subprime borrowers, who have low FICO scores, and often deny their loan applications or offer them interest rates that are very high. Without a score and little or no credit history, lenders have a difficult time figuring out whether the borrower is likely to pay back a loan.

The new score could help applicants who don’t use credit often but are responsible with their monthly payments to get approved for financing. Proponents of scores based on alternative data have said that people who are on time with their other bills should be rewarded similarly to people who are on time with their debt payments when it comes to getting approved for new loans.

But many borrowers who don’t have a traditional FICO score are very risky. Some 40% of the roughly 28 million people who have thin credit files and no score—an additional 25 million have no credit file—have had a major negative event like a bankruptcy or collection and haven’t had any updates on their credit files in at least six months, according to FICO.

Besides increasing their pool of borrowers and loan originations, banks stand to earn more in interest revenue from riskier borrowers. Lenders charge higher interest rates and in some cases extra fees to borrowers who present a higher risk of falling behind on debt payments.

The new score is the latest attempt by FICO to bring more consumers into the credit system and for the firm to stay in lenders’ good graces at a time when banks’ profits have been squeezed by low interest rates and lackluster demand for loans.

The announcement comes as the housing industry seeks ways to make people more creditworthy to increase loan originations, an important source of profit for banks and real-estate agents. The National Association of Realtors, along with other real-estate groups, will sponsor a symposium on credit access on Wednesday, which is billed as the first of its type to discuss ways to increase access to mortgages using alternative credit-scoring systems.

Lenders use FICO scores in 90% of consumer-lending decisions, according to CEB TowerGroup, a financial-services research firm.

About 200 million adults in the U.S. have FICO scores, which range from 300 to 850, based on factors such as whether they pay their debts on time and maintain low credit-card balances, and how long they have been managing debt. The new score won’t apply to them. To have such a score, consumers must have at least one account, generally a loan or credit card, that is older than six months, and at least one account on their credit report must be updated, which can occur when there is activity on it, in the past six months, among other factors, said John Ulzheimer, president of consumer education at CreditSesame.com, a credit-management site, and a former manager at FICO. One account can satisfy both conditions, he said.

Among the potential new crop of borrowers created by the new credit score, those who successfully apply for a credit card and handle their payments well—avoiding falling behind on payments and maintaining low balances—for at least six months will then receive a regular FICO score, which will make it easier for them to get approved by other lenders, including car-loan and mortgage lenders.

The new score comes after years of intensifying pressure from lenders on FICO to help make more people creditworthy. Lenders have been asking FICO for a score that will allow them to lend to more borrowers, including those who haven’t been using credit but are responsible with monthly payments, said Dave Shellenberger, senior director of scoring and predictive analytics at FICO.

“There are more lenders who are very interested in addressing [this]—I don’t think you saw that six or seven years ago,” he said.

Mortgage firms Fannie Mae and Freddie Mac, which require lenders from whom they buy mortgages to use FICO scores when underwriting applicants, began reviewing alternative credit-scoring models, specifically scores from VantageScore Solutions LLC, last year.

VantageScore, which has been a small player in the credit-score market, is starting to make inroads. More than 2,000 lenders, including six of the 10 largest U.S. banks, and other industry participants, such as landlords, used VantageScore scores in their lending decisions in 2014, a 24% increase from 2013.

In January, the Federal Housing Finance Agency, which regulates Fannie and Freddie, directed the companies to “assess the feasibility of alternate credit score models and credit history in loan-decision models” in its list of priorities that it released for this year.

Good day! I simply want to offer you a big thumbs up for the excellent info you have right here on this post.

I will be coming back to your web site for more soon.

I went over this site and I think you have a lot of great information, bookmarked (:.