We’ve had a victory. The DC Council, which is not the friendliest for property owners and landlords, passed on December 20th the “First-Time Homebuyer Benefit Amendment Act.”

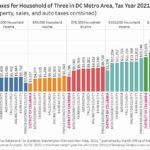

The Act is to help home affordability by helping first-time homebuyers to buy in the District. It helps first-time homebuyers by reducing by as much as half the recordation taxes due on a home purchase for a savings of about $3,600 on a $500,000 home.

DC has some of the highest closing costs in the country and these up-front costs are a big hurdle for many buyers, even those that could otherwise qualify for the mortgage. This change in the law will help more buyers be able to purchase and purchase sooner.

You benefit also. Anyone who owns property in the District will benefit by having more buyers. With more buyers demand stays strong and prices continue to increase.

The District of Columbia Association of REALTORS® (DCAR) stands behind the measure as an invaluable investment in our residents, surrounding communities, and overall economic vitality. The significantly rising costs of DC homes have become an impediment to many in our work force looking to move into homeownership.

“DCAR wholly supports making housing more affordable,” said 2017 DCAR President Johnson. “We commend the Council for recognizing the value of homeownership by taking this critical step toward decreasing some of the highest closing costs in the region. DCAR is confident the (Act) will spur those who have been working so hard to put together the tens of thousands needed for the average home.”